Define

Problem

- Business: With reserve banks raising interest rates – large numbers of mortgage holders will be looking to refinance their loan to other banks. How can we capture the market share and win their home loans.

- Customer: People looking to refinance their home loans will overwhelmed with information and different options.

Opportunities

Optimise and simplification of the marketing funnel journey that will help customers find critical information to refinance their mortgage. In turn, this will increase customer acquisition and growth in home loans.

Deliverables

- Follow-up landing page to capture customers that have viewed the OOH marketing activity.

- Updated page IA that highlights important information for customers wanting to refinance.

Design Process

Existing audit

- Analysis of current page to map out existing content.

- Highlighting opportunities areas that could improve engagement and conversion.

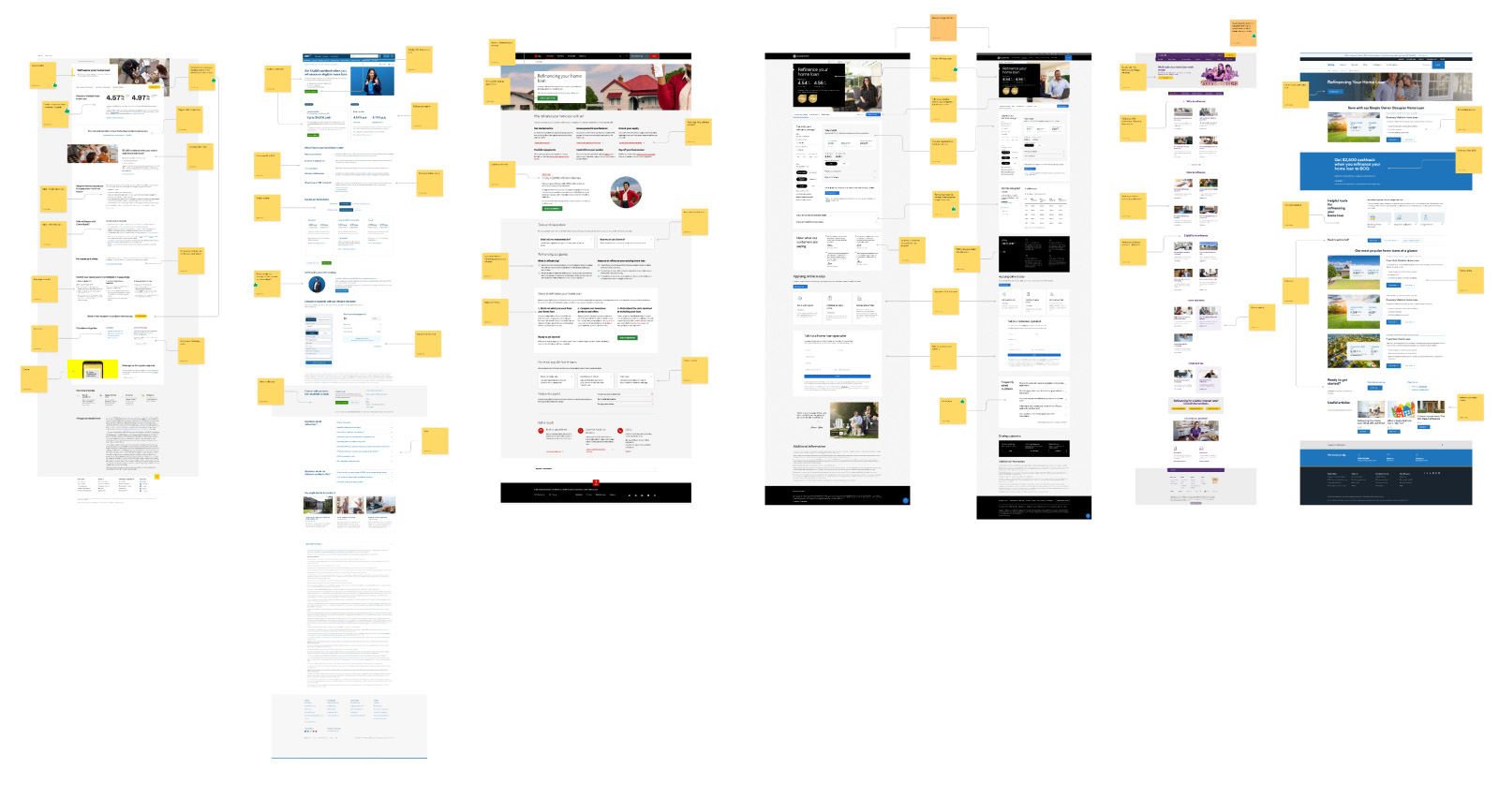

Market research

- Competitor research of other banks (CBA, ANZ, NAB, etc) to compare what content they display.

- Comparison of offers and rates.

- Hierarchy of content.

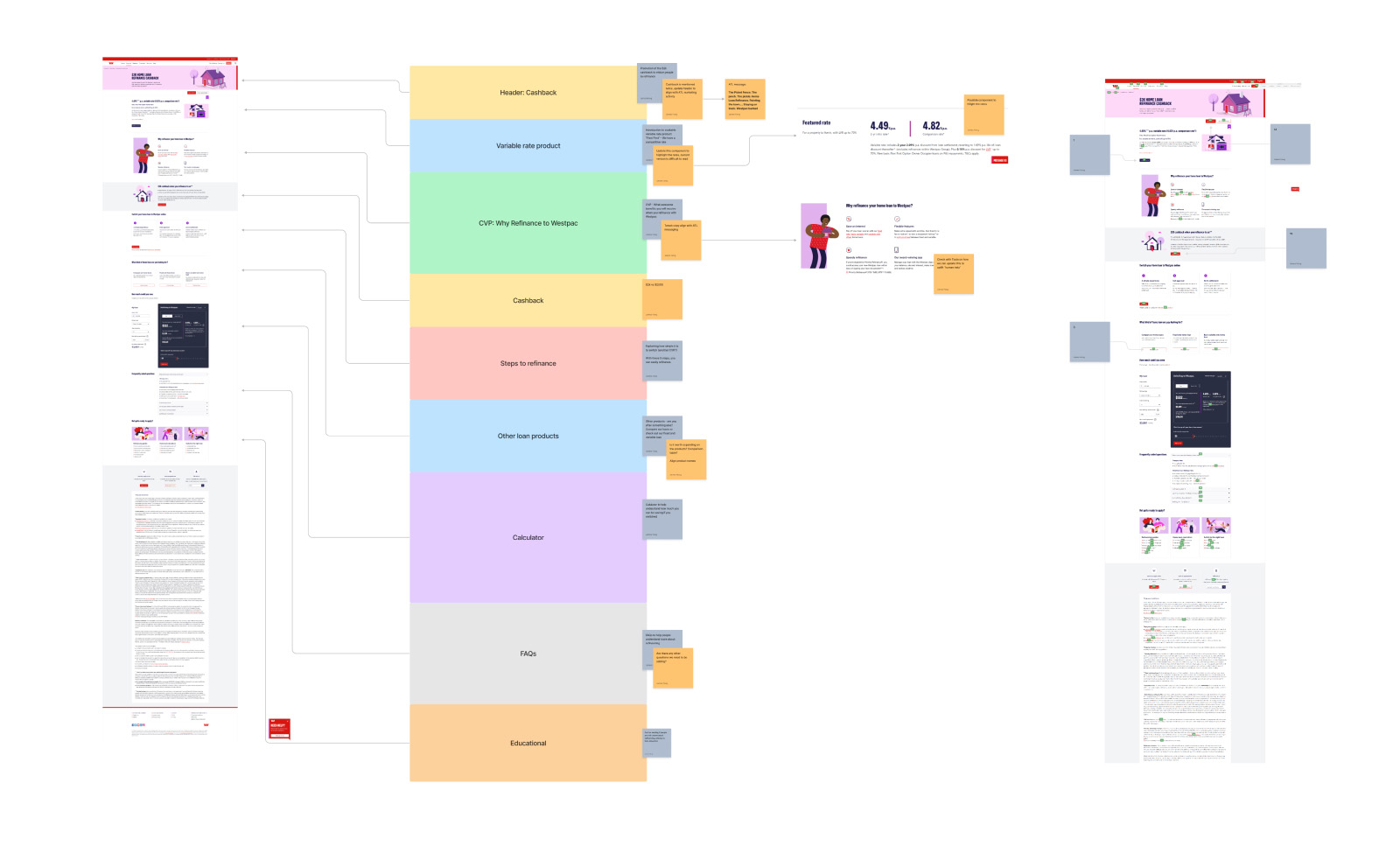

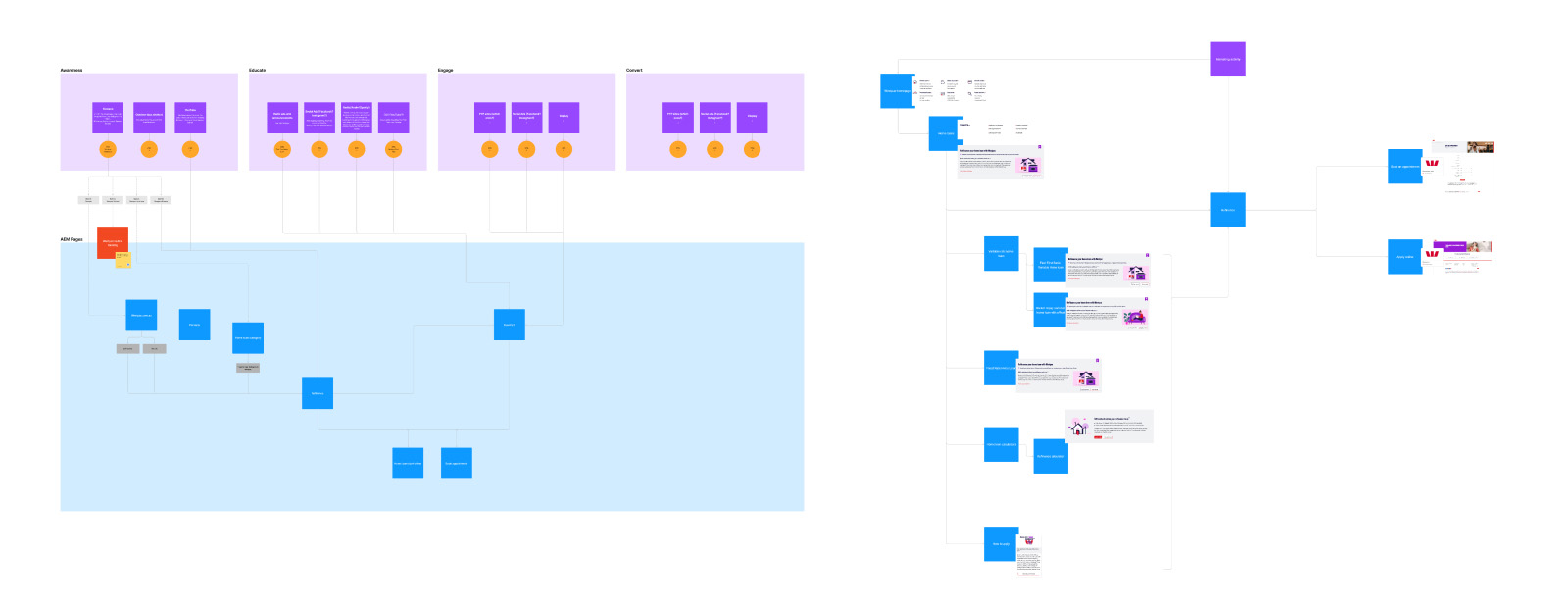

Page IA re-mapping

- Identify ideal IA to help customers convert.

- Using analytics to identify most engaged content.

- Refresh old/outdated components.

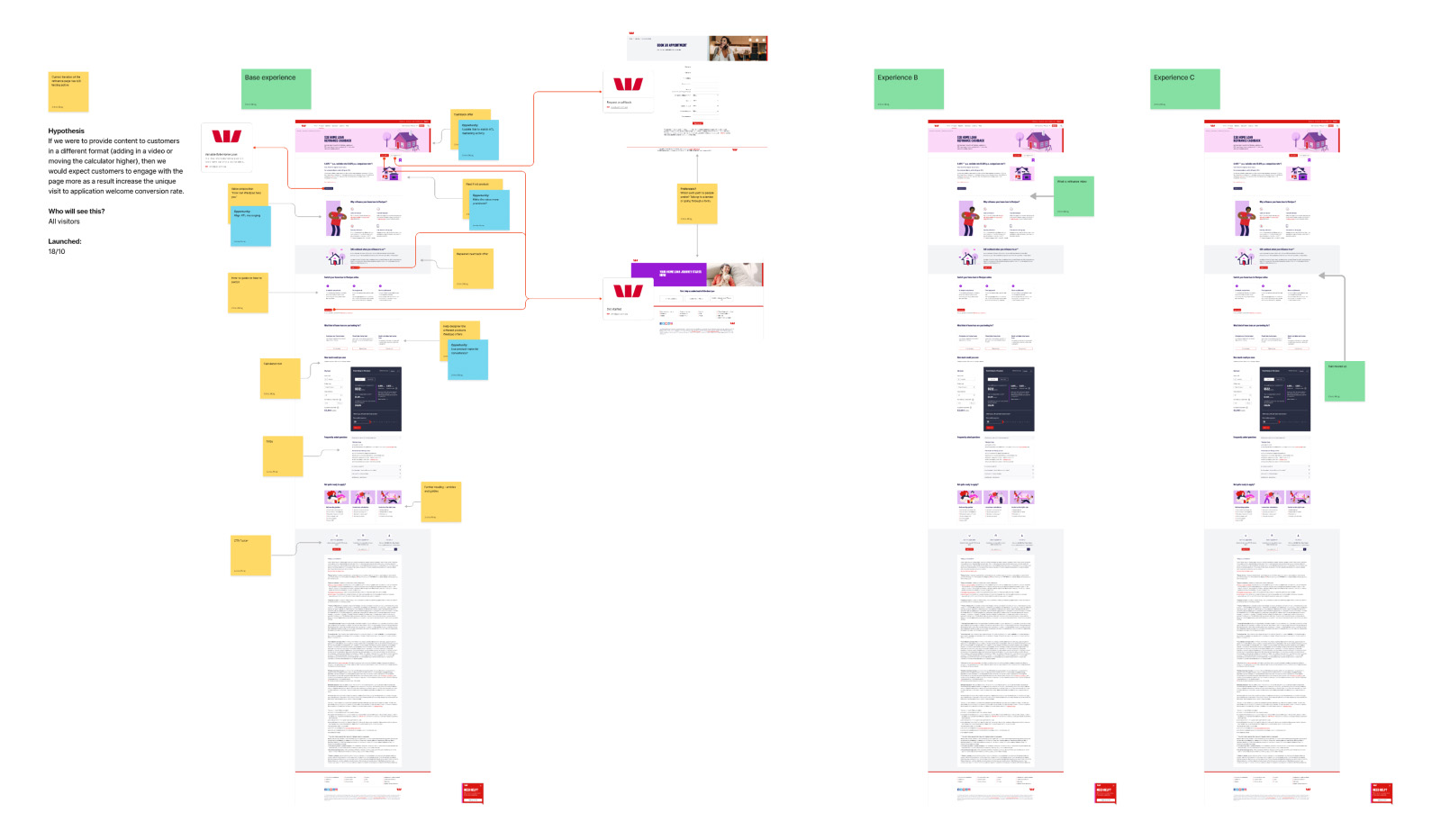

Journeys

- Mapped out end-to-end marketing activity to visualise customer entry-points and flow.

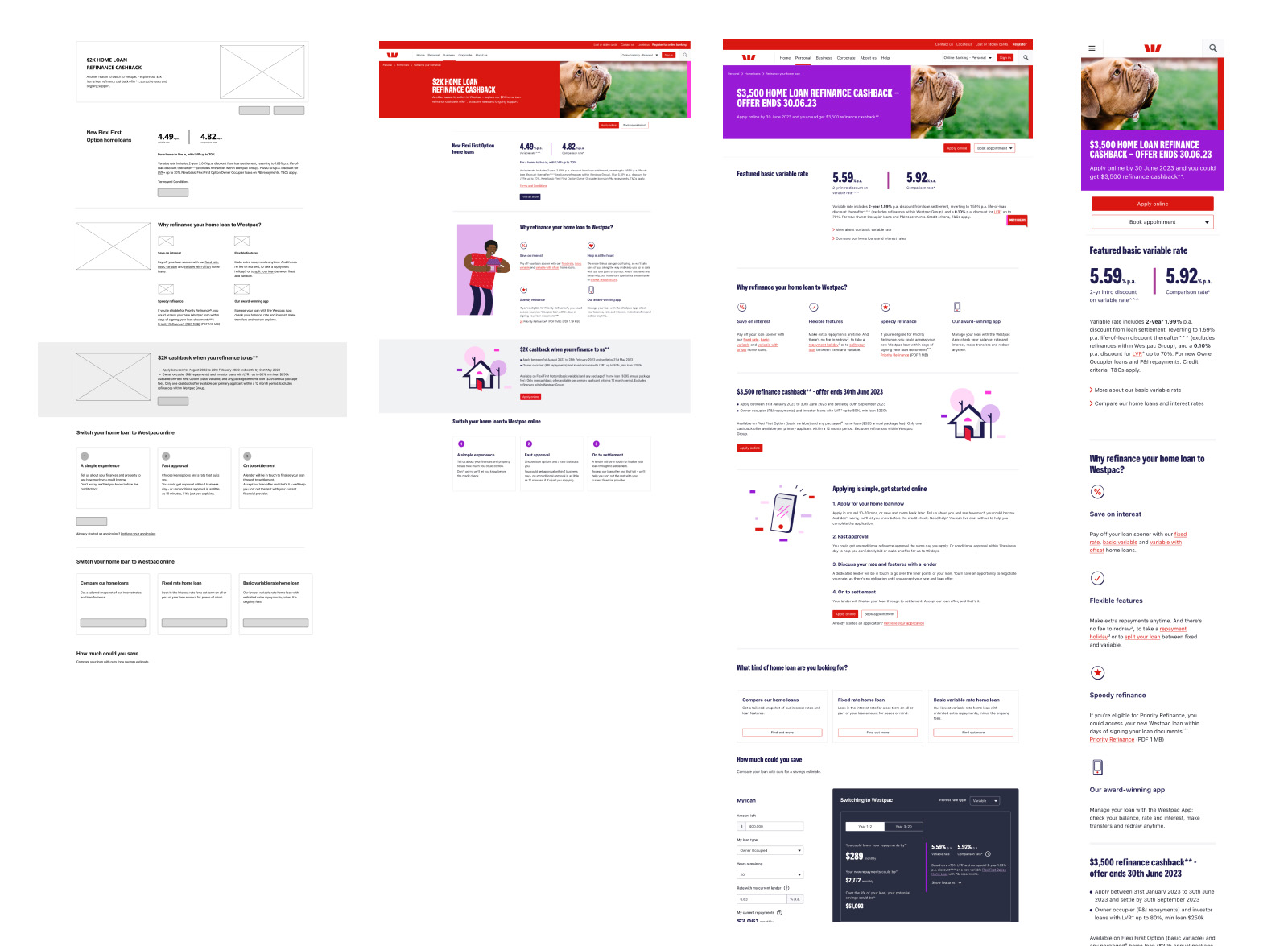

Lo/Hi-fidelity designs

User testing

- A/B testing was set up with 3 versions:

- control

- layout 1

- layout 2

- Testing period of 2 weeks.

- Measurements based on application start and completed.

Outcome

Layout 2 was the winner with an increase of 14% application start and 8% application completed over the control.

Learnings

Customers gravitated towards higher cashbacks and lower interest rates to be the defining reason to why they refinanced.